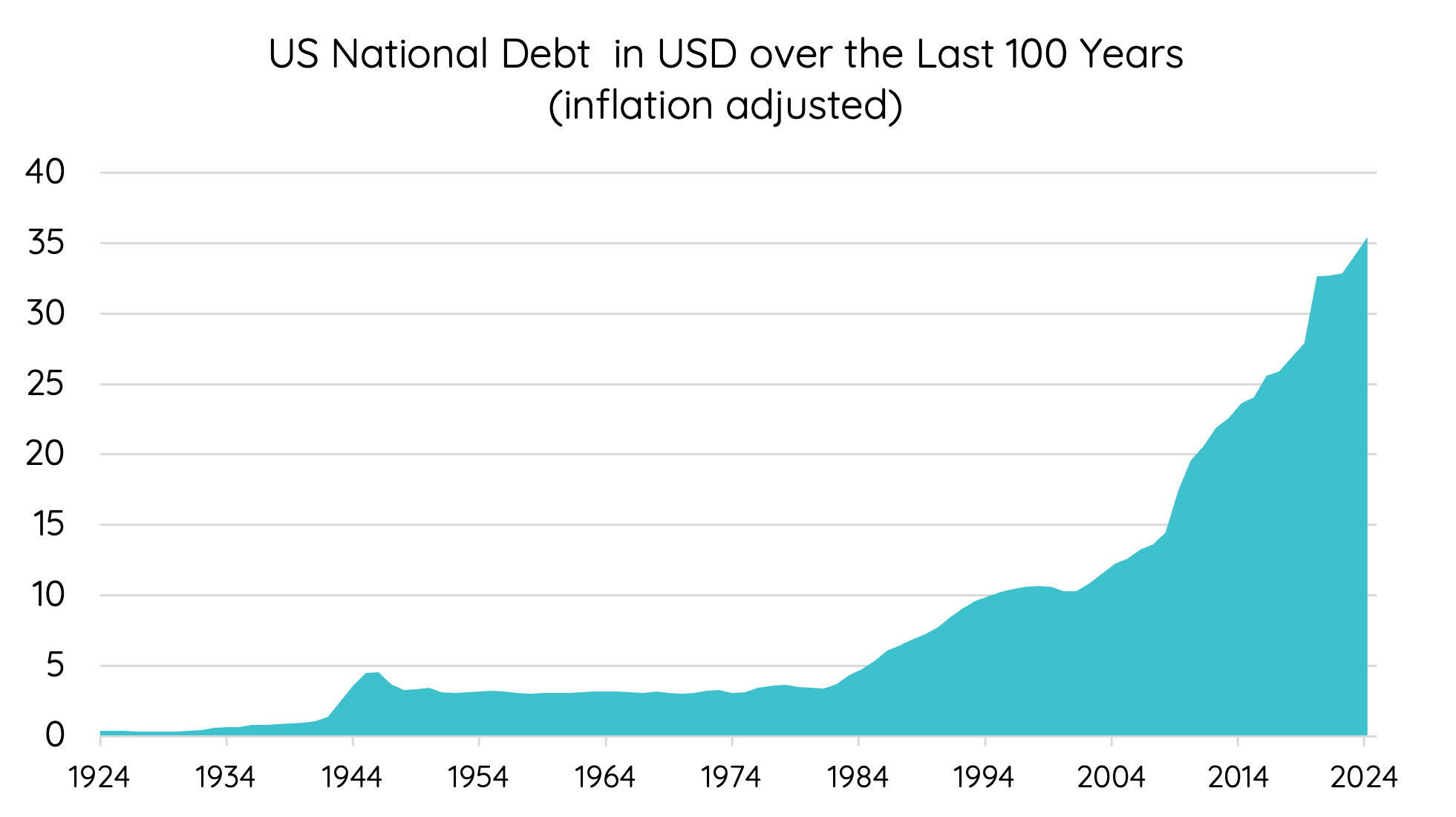

From colonial promissory notes to the trillion-dollar bond market, debt has always been woven into the fabric of America’s economy. But with US government debt now exceeding US$36 trillion — and the gap between income and outgoings widening — the question of whether this historic comfort with borrowing can continue unchecked is becoming harder to ignore.

In this Financial Standard Super article, Talaria Co-CIO Hugh Selby-Smith explores the forces that have underpinned America’s debt habit for more than two centuries, and why the current environment is different. Higher interest rates, slowing globalisation, and a shift toward economic self-reliance in other nations are all challenging the assumption that foreign capital will continue to flow into US assets at the same pace.

Hugh also considers what this means for investors. From the risks of reduced foreign demand for US debt to the potential end of a decades-long era of low rates and easy capital, he outlines the characteristics of portfolios best placed to navigate the change — including short-duration assets, strong balance sheets, real assets, and greater diversification.

Read the full article in FS Super

Source: Talaria, Fiscal Data – US Department of the Treasury, FRED