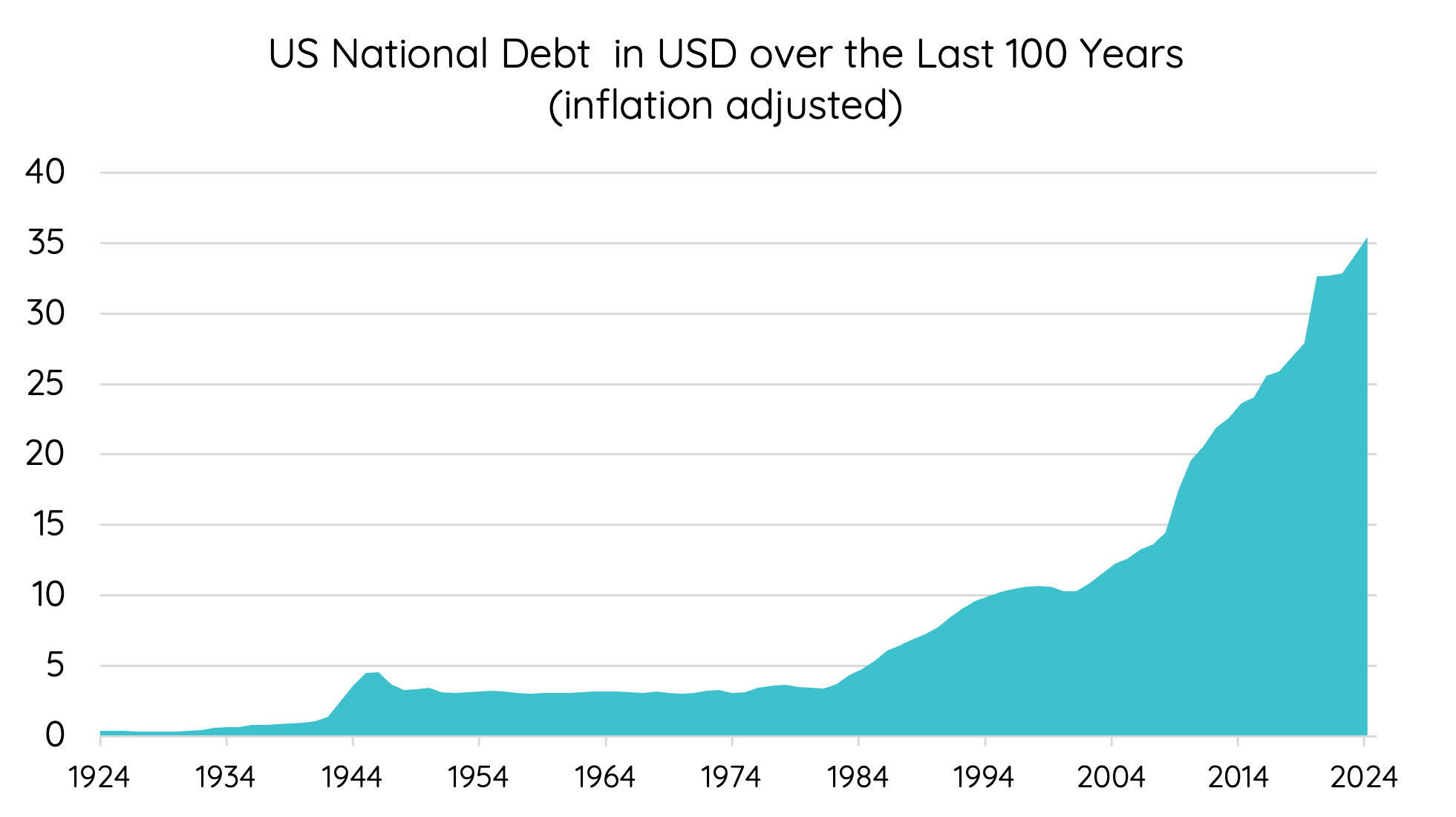

With US government debt projected to outpace economic growth for decades to come, the investment landscape is shifting. In this Adviser Voice article, Talaria Capital’s Co-CIO, Chad Padowitz, examines the scale of the challenge, from interest costs now exceeding Medicare and defence spending, to the US relying on trillions in annual foreign capital inflows to sustain its borrowing. On this, Chad says:

“Each year, the US is borrowing more and more money just to pay its interest bill. The country required US$1.9 trillion in foreign capital inflows last year to balance its external accounts, with foreign investors holding around US$62 trillion in US assets. To maintain current financing patterns, foreign investors would need to add roughly US$2 trillion annually to their holdings.”

He goes on to outline why higher interest rates and greater market volatility call for a renewed focus on resilience, the role of short duration fixed income, real assets, and companies with strong balance sheets in navigating this environment, and why diversifying into under-owned assets could be key to protecting portfolios against the risks of rising US debt.

Read the full article in Adviser Voice

Source: Talaria, Fiscal Data – US Department of the Treasury, FRED