Talaria Global Equity Fund – Currency Hedged (Managed Fund) Cboe: TLRH

A high conviction, value biased approach to construct a portfolio of high quality, large cap companies from around the globe.

A high conviction, value biased approach to construct a portfolio of high quality, large cap companies from around the globe.

*TLRH units should generally trade on Cboe close to the prevailing Net Asset Value during the Cboe trading day (subject to the market bid/offer spread).

**Investing and redeeming units off market via an application from with the Responsible Entity is at the prevailing end of day Net Asset Value (subject to transaction costs and spreads). Investors should review the PDS for the fund.

An indicative NAV per Unit (“iNAV”) will be published by the Fund throughout the Trading Day. The published iNAV is indicative only and might not be up to date or might not accurately reflect the underlying value of the Fund. The price at which the units in the Fund trade on the Securities Exchange may not reflect accurately the NAV of each such unit. The adoption of a robust pricing methodology for the iNAV is intended to minimise this differential, as is the role of the market maker, but will not be able to eliminate it entirely. The market price and iNAV price may also deviate because the market price of the units in the Fund is a function of supply and demand amongst investors wishing to buy and sell such units and the bid-offer spread the market maker is willing to quote for those units. To the extent permitted by law, neither the Issuer or its appointed agent shall be liable to any person who relies on the iNAV. IOPVs / iNAVs are calculated by Solactive AG (Solactive). The Funds and other financial instruments issued or managed by AUFM are not sponsored, endorsed, promoted or sold by Solactive in any way and Solactive makes no express or implied representation, guarantee or assurance with regard to the IOPVs / iNAVs or the Funds and other financial instruments.

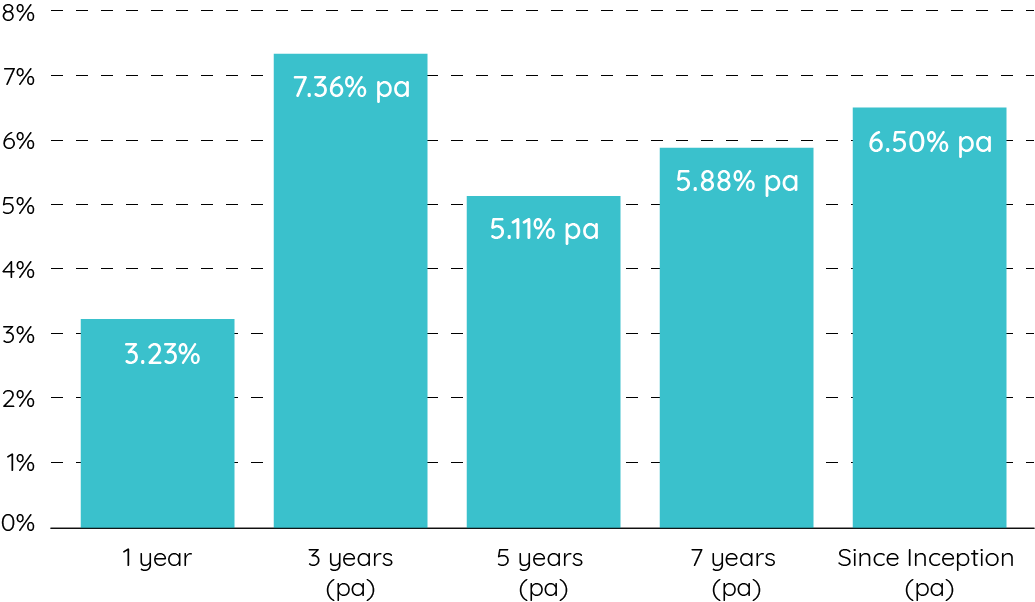

as at 31/03/20241

| 1 Month | 3 Month | 6 Months | 1 Year | 3 Years (pa) | 5 Years (pa) | 7 Years (pa) | 10 Years (pa) | Since Inception (pa)2 | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return % | 1.98 | 1.67 | 4.10 | 8.76 | 9.18 | 8.59 | 7.13 | 6.48 | 7.72 |

| Average Market Exposure4 | 57% | 57% | 57% | 57% | 56% | 56% | 58% | 59% | 58% |

1 Fund Returns are calculated after fees and expenses and assume the reinvestment of distributions.

2 Inception date for performance calculation is 31 December 2012.

3 Past performance is not a reliable indicator of future performance.

4 Average Market Exposure calculated on delta-adjusted exposure of underlying portfolio. Since inception market exposure is calculated from 31 December 2012.

| Frequency | End Period | Cents per Unit | Reinvestment Price |

|---|---|---|---|

| Quarterly | 31-Mar-24 | 8.500 | $5.7704 |

| Quarterly | 31-Dec-23 | 8.5700 | $5.7594 |

| Quarterly | 30-Sept-23 | 0 | 0 |

| Quarterly | 30-Jun-23 | 16.8078 | $5.6610 |

| Quarterly | 31-Mar-23 | 0 | 0 |

| Quarterly | 31-Dec-22 | 0 | 0 |

| Quarterly | 30-Sept-22 | 0 | 0 |

| Quarterly | 30-Jun-22 | 26.4445 | $5.2023 |

| Quarterly | 31-Mar-22 | 8.100 | $5.5794 |

| Quarterly | 31-Dec-21 | 0 | 0 |

| Quarterly | 30-Sept-21 | 0 | 0 |

| Quarterly | 30-Jun-21 | 33.783 | $5.206 |

| Quarterly | 31-Mar-21 | 8.500 | $5.336 |

| Quarterly | 31-Dec-20 | 7.000 | $5.0885 |

*Intra-year distributions for the Currency Hedged Fund tend to be more volatile than the unhedged Fund’s distributions. This is because short term Foreign Exchange movements (and consequent gains/losses on Hedging) can dampen or magnify the Currency Hedged Fund’s distribution. Find out more in the file below:

6 Calculations are based on exit price, net of management fees and expenses and assumes reinvestment of distributions. Past performance is not a reliable indicator of future performance.

7 Illustrates Distribution Returns for the Talaria Global Equity Fund – Currency Hedged (Managed Fund) for the financial year ending 30 June 2023. Inception date is 31 December 2012.

| Company Name | Holding % | Country | Sector | Description |

|---|---|---|---|---|

| Sanofi | 5.3 | France | Healthcare | Top 5 pharmaceutical firm with leading positions in diabetes and rare diseases |

| Johnson & Johnson | 5.1 | USA | Healthcare | Pharmaceutical, medical devices and consumer health products company |

| Roche | 5.0 | Switzerland | Healthcare | A global leader in cancer treatments |

| Gilead | 4.9 | USA | Healthcare | Leading research based biopharmaceutical company |

| WEC Energy | 4.3 | USA | Utilities | A US regulated electricity and gas utility company |

| FEMSA | 4.1 | Mexico | Consumer Staples | Operates largest Mexican convenience store chain, and part owner of Coca-Cola bottling and Heineken |

| Nestle | 3.9 | Switzerland | Consumer Staples | The world’s largest food company measured by revenues |

| Bunzl | 3.6 | UK | Industrials | Multinational distribution and outsourcing business |

| Ambev | 3.5 | Brazil | Consumer Staples | Largest Latin American brewing company |

| Medtronic | 3.3 | USA | Healthcare | A leading medical devices company |

8 Weightings include option positions held and cash backing put options. It assumes that put options will be exercised. Should the put option not be exercised the cash will revert to the unencumbered cash portfolio or may be used to cover further put options.

9,10 Weightings include option positions held and cash backing put options. It assumes that put options will be exercised. Should the put option not be exercised the cash will revert to the unencumbered cash portfolio or may be used to cover further put options.

*USA includes American Depositary Receipts (ADRs) listings.

| APIR Code | WFS0547AU |

| Inception Date | 31 December 2012 |

| Management Fee | 1.20% p.a. |

| Liquidity | Daily |

| Buy / Sell Spread | 0.25% / 0.25% |

| Distributions | Quarterly |

| Recoverable Expenses | 0.12% of the net asset value of the Fund for the financial year |

| Major Platform Availability | Asgard, Ausmaq, BT Wrap, BT Panorama, CFS FirstWrap, Hub24, IOOF, Linear, Macquarie, MLC Wrap, MLC Navigator, Netwealth, Powerwrap, Praemium, Grow Wrap/Voyager, Mason Stevens |

Learn more about our listed and unlisted funds, our history, our process and more.

The Talaria strategy was founded in Melbourne, Australia in 2005. The Talaria Asset Management business was founded in 2018. The investment strategy has remained unchanged since inception in 2005

No the two funds available for investors run the same strategy, however one has the additional feature of Currency Hedging.

You have a choice as to whether you apply for and redeem units via the responsible entity (RE) or buy and sell units on Cboe in the same way you buy other publicly listed ETFs and shares.

TLRA and TLRH units should generally trade on Cboe close to the prevailing Net Asset Value during the Cboe trading day (subject to the market bid/offer spread).

You can buy and sell units off market with the Responsible Entity at the prevailing end of day Net Asset Value (subject to transaction costs and spreads).

Purchasing via the listed process, also known as an active ETF, is accessible via your share trading platform, stockbroker or financial advisor.

Investing via the unlisted process can be done via the Fund’s Responsible Entity Australian Unity – more information is available here.

We believe the consideration, understanding and management of ESG issues in conjunction with financial analysis can generate better long-term performance for clients. Similarly, active engagement with company management seeks to encourage greater awareness of issues impacting corporate sustainability. To assist with the identification of relevant issues we complement our internal analysis with the resources of dedicated ESG research firms. Find out more on our dedicated ESG page.

Yes, Talaria has a Highly Recommended rating from Zenith Investment Partners for both its listed and unlisted versions of the Talaria Global Equity Fund (Managed Fund) and The Talaria Global Equity Fund – Currency Hedged (Managed Fund).

Talaria is also rated Recommended by Lonsec for both funds.

By clicking below you are confirming that you are an Australian wholesale client for the purposes of section 761G of the Corporations Act 2001. Access to this information is provided on the condition that it is not passed on to any person who is a retail client within the meaning of section 7610 of the Corporations Act 2001.